At this moment, the United States is in the middle of a concerted financial meltdown driven entirely by the destructive policies of Donald Trump. Trump's massive tariffs and incoherent actions are threatening a global recession—if not depression. But they have already resulted in enormous, irreprabable harm to the United States.

That's not a threat. It's a done deal.

Not only have stock markets plummeted more than 10% in a week, but the value of the U.S. dollar has declined against other currencies. At the same time, the rates on U.S. Treasury bonds have soared to over 4.5%. This is bad. This is apocalyptically bad.

As analysts on conservative networks are prone to point out—when they are willing to acknowledge that the markets exist—stock market corrections are nothing new. Every few years, Wall Street wakes up, gets nervous that it may have been a little too exuberant, and spends a couple of weeks determinedly driving numbers down. This happened as recently as 2022 when the S&P 500 fell a full 20% over concerns about inflation, only to rebound in the following months.

But when that happens, the usual result is two-fold: rates on U.S. bonds go down, and the value of the dollar increases. That happened in 2022, with bond rates plunging (until the Fed raised interest rates) and the value of the dollar temporarily spiking above the price of a Euro.

The reason for this is simple enough: When companies, hedge funds, and big investors see stocks going down, they look for some other place to stash their money until the storm has passed. That can come in the form of buying up bonds, which drives the bond rate down, or a "rush to cash" that drives the value of the dollar up.

At first, the Trump Slump followed that pattern. When stock markets fell on April 2, so did bond prices as investors gravitated to what was seen as the safer investment. But two days into the ongoing destruction in the markets, the pressure went the other way.

Bond rates started to rise. Instead of buying bonds to protect against the fall of stocks, investors were also selling bonds. At the same time, the value of the dollar declined against the Euro and Swiss franc.

All of this is a strong indicator that what's happening is a lot bigger than a temporary sell-off in the markets. It's a fundamental statement of distrust in U.S. financial institutions.

Foreign investors own 40% of U.S. stocks. They also control at least 30% of U.S. bonds with foreign governments holding $8.5 trillion. If these investors flee American markets, the damage that it would do is inestimable. And the evidence suggests they are leaving. These trends reinforce the de-dollarization movement that has been gaining steam since the first time Trump occupied the White House.

All of this reflects a growing distrust in U.S. institutions, U.S. agencies, and U.S. citizens by foreign officials. And that distrust has been well earned.

Trump's erratic policies, his willingness to betray and threaten allies, his disregard for both facts and the law, and his complete misunderstanding of global trade give no reason to think that America can be trusted. Who could be sure of what Trump's policies are tomorrow? Or next week? Will he decide to double tariffs again on a whim? Will he seize foreign assets in the U.S.?

The fact that U.S. voters put Trump back in office despite leaving the economy in shambles and a global pandemic raging in his first go-round is just a small part of the evidence that Americans just don't care about being good global citizens. American citizens twice put up a middle finger to the world, declaring themselves all in a program of isolationism, abandonment, and revenge. Confused Republicans at some up-state diner may be claiming that "this isn't what I voted for," but the rest of the world got the message loud and clear.

We don't know, we can't know, what Trump will do next. He is entirely a creature of ego, driven mad by the endorsement of his voters. He's a monster run amok, who believes himself to be smarter than all the generals, scientists, and economists. Absolutely nothing will convince him to do anything other than what his next randomly-firing synapse proposes so long as there are people on hand to praise him and let him win at golf.

In any other administration, the president would already be huddled with advisors trying to stave off collapse

— Anne Applebaum (@anneapplebaum.bsky.social) 2025-04-09T11:17:29.514Z

The trade war is still escalating, but the United States has already lost. No other nation will again think of the United States as either a trusted ally or a safe harbor in a financial storm. Trump might end the tariffs tomorrow, and the stock market might reward him with a bounce, but the damage he has done goes to the bone. It will never heal.

And actually, there is one prediction that can definitely be made. Because it was obvious from the outset.

- Trump will claim that tariffs have raised some enormous sum and insist it came from foreign governments — even though it came straight from your pockets.

- Trump will put his name on a check to taxpayers that claims to be returning this windfall of his brilliant tariffs and DOGE cuts.

- Trump will insist that we no longer need income taxes because tariffs and cuts can do it all.

The first part of this prediction has already proven true. The rest will follow soon.

Here's a fourth prediction: Republicans will make "ending the IRS" their talking point in the next election cycle. If there is one.

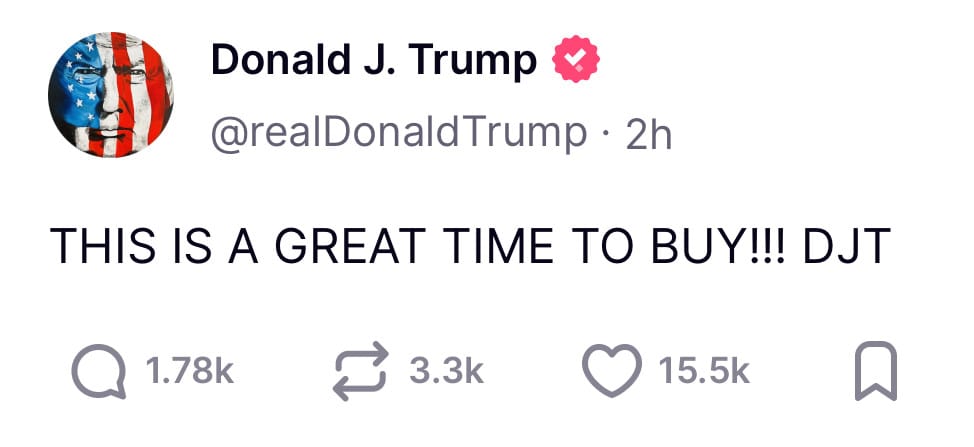

After this was written Trump posted this message onto his personal social media platform.

15 minutes later, Trump put a 90-day hold on tariffs to nations other than China.

This demonstrates how little faith Trump has in tariffs to work and why no one would be foolish enough to uproot a factory and move it to the United States based on a policy that may change minute to minute.

It also shows just how clearly Trump is using tariffs and tariff threats to manipulate the stock market so that he and his insiders can run away with billions. Under any rational system of regulation, what Trump did over the last week would be a felony. But for Trump, there is no law.

Comments

We want Uncharted Blue to be a welcoming and progressive space.

Before commenting, make sure you've read our Community Guidelines.